Basic Policy on Corporate Governance

Basic Policy on Corporate Governance

1. Basic Stance on Corporate Governance

We see corporate governance as the basic framework for corporate management, the purpose of which is to establish systems that enable efficient and sound corporate management and to properly align the interests of stakeholders who are involved in various aspects of our company’s management, such as shareholders, creditors, employees, business partners, consumers, and local communities. Therefore, we consider the enhancement of corporate governance to be a key issue for management. We will strive to comprehensively enhance corporate governance by building a management structure that enables accurate decision-making to increase corporate value, prompt business execution based on such decisions, and proper supervision and inspection, as well as by conducting thorough training and education to raise the compliance awareness of each officer and employee.

on Desember 22, 2023

2. Basic Policy on Securing Shareholder Rights and Equitable Treatment

We will take appropriate measures to ensure that the rights of shareholders are substantially secured, such as providing information thought to help shareholders make appropriate decisions in a timely, accurate, and fair manner, and maintaining an appropriate environment for the exercise of rights at the Shareholders’ Meeting. At the same time, we will ensure the substantial equality of shareholders by maintaining an environment in which all shareholders are able to exercise their rights appropriately, while giving full consideration to the exercise of rights by minority shareholders and foreign shareholders.

3. Basic Policy on Appropriate Cooperation with Stakeholders Other Than Shareholders

We fully acknowledge that our sustainable growth and creation of medium- to long-term corporate value are the result of the resources provided by and contributions made by our various stakeholders, including our employees, customers, business partners, creditors, and local communities. This being the case, we will strive to cooperate appropriately with these stakeholders.

In addition, the Board of Directors and management will exercise their leadership in fostering a corporate culture and climate that respects sound business ethics and the rights and positions of these stakeholders.

We will contribute to the creation of a prosperous society by instilling our management philosophy and code of conduct in each and every employee and aiming to be a company that prospers together with its stakeholders, while being aware of our role as a company that leads others in providing strong support to enterprises adopting IT and focusing on pioneering the evolution of solutions for core business operations ahead of the industry.

4. Basic Policy on Ensuring Appropriate Information Disclosure and Transparency

In order to provide shareholders and investors with accurate information in a timely and fair manner, we will disclose information in accordance with the Financial Instruments and Exchange Act and the Timely Disclosure Rules prescribed by Tokyo Stock Exchange, Inc. We will also disclose information that is not subject to the Timely Disclosure Rules in a fair manner, so that such information is not concentrated in the hands of certain shareholders and investors, and will provide information that is useful to our shareholders and investors.

5. Basic Policy on the Responsibilities of the Board of Directors, etc.

The primary role and responsibility of the Board of Directors is as follows. In order to enhance corporate value, our Board of Directors, based on its fiduciary responsibility and accountability to shareholders as the decision-making body for the execution of key operations and as the supervisory body for overall business execution, will establish a management philosophy in order to promote the company’s sustainable growth and improvement of medium- to long-term corporate value, as well as to develop profitability, capital efficiency, etc. In addition, the Board of Directors will formulate, clarify, and present management policies to management at the beginning of each fiscal year and ensure that management executes business efficiently through prompt and decisive business execution based on these policies. Regarding the matters to be discussed at Board of Directors’ meetings, etc., each officer will receive a detailed explanation in advance from the officer in charge of the matter, and after gaining an understanding of the company’s management issues, will attend the Board of Directors’ meeting and express his or her opinion.

We also appoint outside directors to uphold and maintain the Board’s supervisory function, to obtain oversight and advice from a broad range of knowledge, and to ensure the effectiveness of management supervision by the Board of Directors by having outside directors express their opinions from an objective standpoint at Board of Directors’ meetings. In addition, we aim to reinforce our auditing structure by appointing outside Audit & Supervisory Board members to ensure audit independence.

6. Basic Policy on Dialogue with Shareholders

Recognizing that constructive dialogue with shareholders is useful for our sustainable growth and the enhancement of our corporate value over the medium- to long-term, we have appointed an officer and a department in charge of IR and will create opportunities for active dialogue with shareholders and investors.

Through such dialogue, our senior management and directors (including outside directors) will listen to our shareholders and duly consider their interests and concerns while explaining their management policies in a clear manner that is easily understood by our shareholders. They will make efforts to obtain our shareholders’ understanding, while also striving to gain a balanced understanding of our stakeholders’ positions, including those of our shareholders, and to respond appropriately based on such understanding.

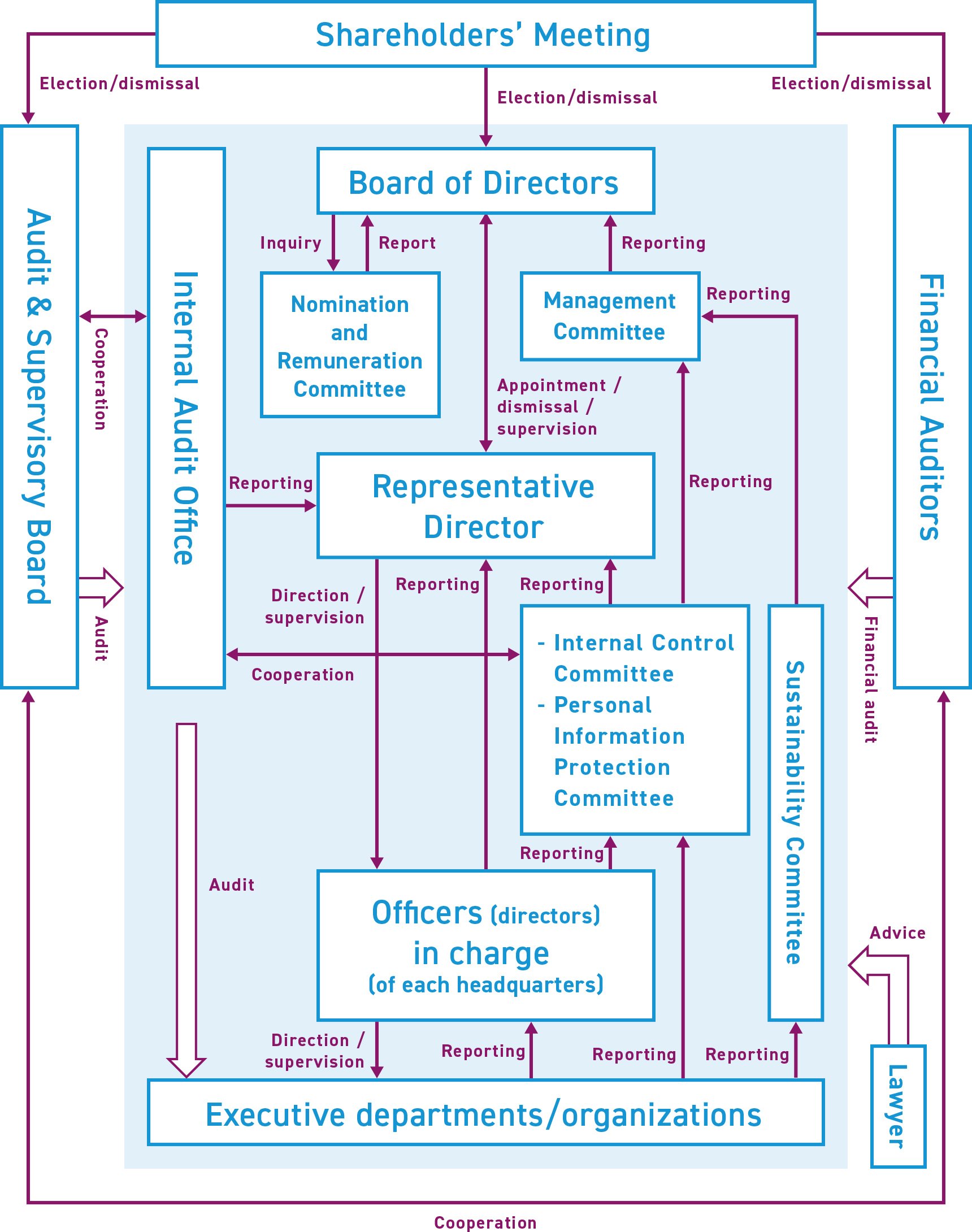

Corporate Governance Structure Chart

Shareholders’ Meeting

The Shareholders’ Meeting is OBC’s highest decision-making body. It resolves matters stipulated in the Companies Act and the Articles of Incorporation. The Annual General Meeting of Shareholders is chaired by the President and Representative Director and attended by shareholders, nine directors (including five outside directors) and three Audit & Supervisory Board members (including two outside Audit & Supervisory Board members). The shareholders entitled to exercise their rights at the Annual General Meeting of Shareholders are the shareholders who are listed in the shareholder registry as of March 31 that year.

The exercise of voting rights at the Shareholders’ Meeting is a key right that shareholders possess. To enable shareholders to appropriately exercise their right to vote, we provide an environment for shareholders to exercise their voting rights via the internet, in addition to exercising their rights in the voting form. On the day of the Shareholders’ Meeting, each matter to be reported and other agenda items are presented in an easy-to-understand format with visuals and narration to help attending shareholders deepen their understanding of the company.

Board of Directors

The Board of Directors is the body that makes business-related decisions to improve OBC’s corporate value and supervises the business execution function as a management supervisory body. The Board is chaired by the President and Representative Director and consists of nine directors (four full-time directors and five outside directors) and three Audit & Supervisory Board members (one full-time Audit & Supervisory Board member and two outside Audit & Supervisory Board members), and meets once a month as a general rule.

Nomination and Remuneration Committee

The Nomination and Remuneration Committee is a discretionary body under the Board of Directors. Its purpose is to enhance the corporate governance structure by strengthening fairness, transparency, and objectivity in the evaluation and decision-making process regarding director nominations and remuneration, etc. In response to inquiries from the Board of Directors, the committee deliberates on matters related to nomination and remuneration, etc., and reports back to the Board of Directors.

The committee shall consist of three directors or outside experts selected by the Board of Directors, the majority of whom shall be outside directors or outside experts.

Management Committee

Management Committee meetings are held with the attendance of full-time directors and relevant managers, and outside directors as necessary. The committee discusses and decides on basic policies and strategies related to management, as well as key matters related to the execution of management. Matters discussed at Management Committee meetings, including a summary of the agenda, are reported to the Board of Directors, and the key matters are decided on by the Board of Directors. As a general rule, the Management Committee meets once a month.

Sustainability Committee

Aiming to promote initiatives for sustainability, the Company has established the Sustainability Committee with the President and Representative Director as the Chairperson. Initiatives, matters related to information disclosure, etc. discussed at the Sustainability Committee are deliberated and decided by the Management Committee, and reported to the Board of Directors. Furthermore, reports are received from the Management Committee with regard to important matters, and the Board of Directors makes decisions on them.

Audit & Supervisory Board, etc.

The Audit & Supervisory Board consists of three Audit & Supervisory Board members, of which two are outside Audit & Supervisory Board members, and is chaired by a full-time Audit & Supervisory Board member. The board is responsible for the auditing function and, in line with OBC’s management policies and guided by the Code of Audit and Supervisory Board Member Auditing Standards, conducts audits to help OBC achieve its management goals and improve and enhance management controls. Audit and Supervisory Board members attend key meetings for the execution of management, such as Board of Directors meetings and Management Committee meetings, and audit the directors and the executive function.

In addition, the Internal Audit Office, Internal Control Committee, and Personal Information Protection Committee have been established as internal audit bodies.

The Internal Audit Office conducts financial audits and operational audits in-house, makes proposals for the improvement of operations, and reports audit results to the Audit & Supervisory Board. It is headed by the Head of the Internal Audit Office, who is assisted in auditing duties by one Internal Audit Office staff member and two to three other employees.

The Internal Control Committee and Personal Information Protection Committee report audit results to the Board of Directors and the Audit & Supervisory Board to support cross-organizational activities and perform continuous monitoring. These committees consist of auditors selected from each headquarters and are led by the President and Representative Director.

Lawyer and Financial Auditors

OBC has entered into a consulting agreement with a law firm regarding corporate management and daily operations, and has adopted a structure in which the company can receive advice as necessary for reference when making management decisions. In addition, in order to broadly verify the appropriateness and efficiency of OBC’s business execution, Audit & Supervisory Board members and internal auditors ascertain the status of internal controls, etc., based on advice and recommendations from the Financial Auditor, and report their findings to the Audit & Supervisory Board.

Others

Sales meetings are held once a month at the head office to discuss specific measures and sales strategies related to company management. The members consist of the President and the heads of every division, including the heads of branches and sales offices across Japan, who report on the sales situation in their respective regions and discuss any sales issues that need to be shared.

In addition, a forum has been established for discussions on sales strategies, etc., held once every two weeks with General Managers and Managers of each headquarters and division as members.